When does the annual budget process begin?

The fiscal year begins each year on July 1. The process for developing a new budget typically begins in the fall prior to a new fiscal year (FY).

For example, Town staff began discussing and developing the FY21-22 budget in mid-September of 2020. In October 2020, Town Council held two public meetings to discuss Town-wide goals, Council and staff budget requests, major building and infrastructure projects, recycling, and other proposed big-ticket items.

From there, Town staff developed a draft comprehensive budget, and a public meeting was held in January 2021 to present an overview of that entire budget to Council. An additional public meeting was held in February 2021 to review and discuss any adjustments made to the draft budget.

When will the FY21-22 budget be approved?

A final draft of the FY21-22 budget will be presented to Council during its regular monthly meeting on March 18, 2021. At that meeting, citizens will have an opportunity to provide input on the budget during a public hearing.

Any potential changes to the budget based on feedback received during the public hearing will be discussed by Council in April, with adoption of the FY21-22 budget scheduled for Council’s regular monthly meeting on April 15, 2021.

The FY21-22 budget will go into effect on July 1, 2021 and will run through June 30, 2022.

Where can I view the proposed budget?

The draft version of the FY21-22 budget manual is available to view and download on the Town of Leland website.

Why does the proposed budget include a tax increase?

The Town of Leland has maintained the current tax rate of 21 cents per $100 valuation since FY17-18. Since that time, the Town has experienced significant natural growth. In order to continuously improve community services such as fire and police protection and accomplish Town-wide goals related to the maintenance of streets and improvements to the park system – both within the upcoming fiscal year and as part of long-range planning – a four-cent tax increase has been recommended in the FY21-22 budget.

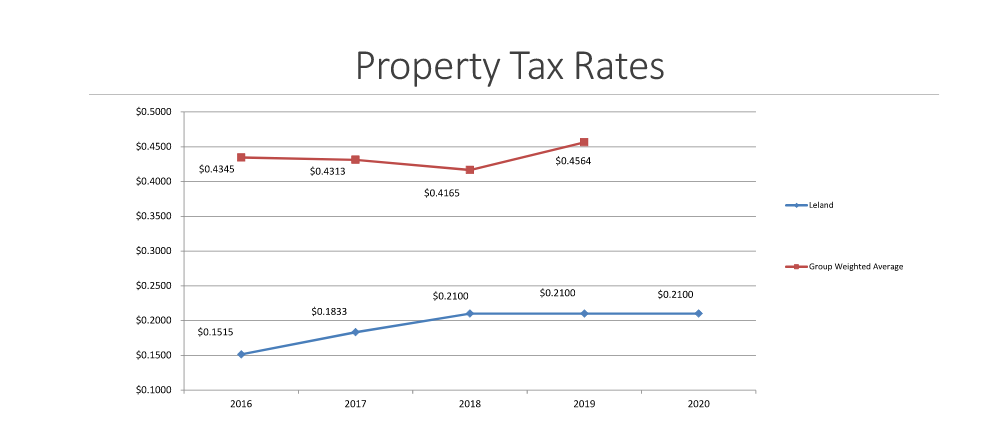

How does Leland’s tax rate compare to other municipalities of similar size?

The Town of Leland has consistently maintained a tax rate far below the state average for municipalities of similar size. According to auditing firm Thompson, Price, Scott, Adams & Co, P.A., Leland’s proposed tax rate of 25 cents for FY21-22 is 20 cents lower than the 2019 state average for similarly sized municipalities.

How much revenue would a tax increase generate for the Town?

If approved, the four-cent tax rate increase would generate an additional $1.2 million for the Town of Leland. To put that in perspective, $1.2 million is approximately the amount by which the Leland Fire/Rescue Department’s needs have increased for the coming fiscal year, due to a demand for additional full-time firefighters, protective gear, and a replacement fire truck. The Leland Police Department is similarly experiencing an increase in staffing and equipment needs of nearly $1 million.

How would the proposed tax increase, if approved, impact me?

A 25-cent per $100 valuation would increase the annual tax burden on property owners by approximately $40 to $200, depending upon individual home values.

For example, homes valued at $100,000 would see an annual increase of $40 from $210 to $250, which breaks down to about $3.30 per month; $200,000 homes would see an increase of $80 ($7 per month); $300,000 homes would see an increase of $120 ($10 per month); $400,000 homes would see an increase of $160 ($13 per month); and $500,000 homes would see an increase of $200 ($17 per month).

What new or expanded services are included in the proposed FY21-22 budget?

The proposed FY21-22 budget supports the relocation of the existing fire station at 1004 Village Road to the Municipal Operations Center site at 1970 Popular Street, in an effort to improve response times in an area of the existing fire district that continues to experience rapid growth (Highway 74 corridor). Similarly, the budget supports the conversion of the current satellite fire station at 187 Old Lanvale Rd. to a permanent, fully staffed station to aid in reducing response times to fire and life-safety incidents in the Highway 17 area.

The proposed budget also includes funding to extend roadways, install sidewalks, and make other needed improvements on numerous Town streets and roads and to develop a new park on Kay Todd Road.

Highlights of the proposed FY21-22 budget include:

- Approximately $1.65 million in funding for eight street/road projects

- $989,000 in park improvements, including $489,000 for Founders Park

- Additional Leland Police patrol vehicles and equipment

- Replacement ladder fire truck and protective gear

- The addition of 11 new employees – four Police patrol officers, three firefighters, three maintenance workers, and one planner

Does the proposed budget include a site for yard debris drop-off?

Yes. The proposed FY21-22 budget includes the reinstatement of a Town drop-off site for yard debris beginning July 1, 2021. The fee-based site for Town of Leland residents will be located at the Town’s Municipal Operations Center at 1970 Popular Street.

How will funds previously allotted for recycling be used in the proposed budget?

The removal of the cost to the Town for curbside recycling was included in the preliminary budgets discussed by Council in the fall. Such funds are included in the Town's General Fund, which funds services such as police and fire protection, street maintenance, and parks.

The cost of once-per-month curbside recycling was expected to rise to more than $600,000 in FY21-22, with additional cost increases expected in the future as the recycling industry continues to experience inefficiencies and overall decline.

Residents are now able to contract directly with GFL or other curbside recycling companies for bi-weekly service.